Take a look at our newest merchandise

One of many core challenges that Rapidus will face when it kicks off quantity manufacturing of chips on its 2nm-class course of know-how in 2027 is lining up prospects. With Intel, Samsung, and TSMC all slated to supply their very own 2nm-class nodes by that point, Rapidus will want some type of benefit to draw prospects away from its extra established rivals. To that finish, the corporate thinks they’ve discovered their edge: totally automated packaging that may permit for shorter chip lead occasions than manned packaging operations.

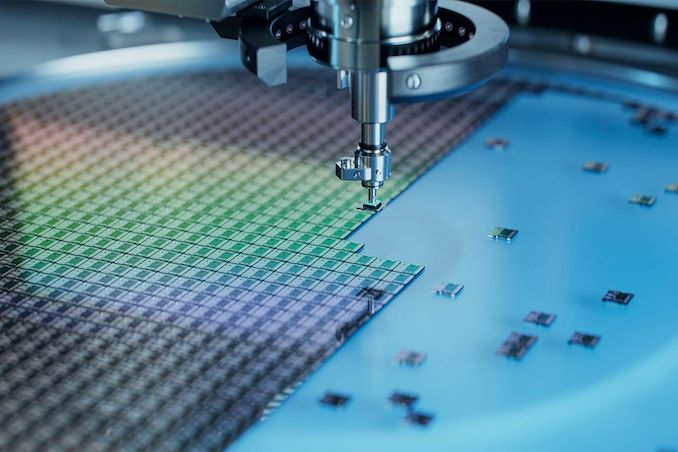

In an interview with Nikkei, Rapidus’ president, Atsuyoshi Koike, outlined the corporate’s imaginative and prescient to make use of superior packaging as a aggressive edge for the brand new fab. The Hokkaido facility, which is presently beneath building and is anticipating to start tools set up this December, is already slated to each produce chips and provide superior packaging providers throughout the identical facility, an business first. However in the end, Rapidus greatest plan to distinguish itself is by automating the back-end fab processes (chip packaging) to offer considerably quicker turnaround occasions.

Rapidus is targetting back-end manufacturing particularly as, in comparison with front-end (lithography) manufacturing, back-end manufacturing nonetheless closely depends on human labor. No different superior packaging fab has totally automated the method to this point, which supplies for a level of flexibility, however slows throughput. However with automation in place to deal with this facet of chip manufacturing, Rapidus would have the ability to enhance chip packaging effectivity and pace, which is essential as chip meeting duties change into extra complicated. Rapidus can also be collaborating with a number of Japanese suppliers to supply supplies for back-end manufacturing.

“Previously, Japanese chipmakers tried to maintain their know-how improvement completely in-house, which pushed up improvement prices and made them much less aggressive,” Koike informed Nikkei. “[Rapidus plans to] open up know-how that needs to be standardized, bringing down prices, whereas dealing with vital know-how in-house.”

Financially, Rapidus faces a big problem, needing a complete of ¥5 trillion ($35 billion) by the point mass manufacturing begins in 2027. The corporate estimates that ¥2 trillion can be required by 2025 for prototype manufacturing. Whereas the Japanese authorities has supplied ¥920 billion in support, Rapidus nonetheless must safe substantial funding from personal buyers.

Resulting from its lack of monitor file and expertise of chip manufacturing as. nicely as restricted visibility for achievement, Rapidus is discovering it tough to draw personal financing. The corporate is in discussions with the federal government to make it simpler to boost capital, together with potential mortgage ensures, and is hopeful that new laws will help on this effort.

![[2024] MSI Aegis R2 C14NUF9-829US (Intel Core i9-14900F, 128GB DDR5 RAM, 2X 2TB NVMe SSD, NVIDIA GeForce RTX 4070 Ti Super, Windows 11) Gaming Desktop PC](https://m.media-amazon.com/images/I/81i1KVslX4L._AC_SL1500_.jpg)